Wise Giving Wednesday: Myths and Misperceptions of Charity Salaries

Questions about executive compensation at charitable organizations have been an issue of donor interest almost as long as charities have been soliciting. Unfortunately, there are some donors who believe that all charities should be run by volunteers. And of those who support paying a staff to run things, they argue the amount should be relatively low. Of course this is neither fair, practical, or realistic. Employees of charities accept they usually will not be paid as much as those in other sectors but they also need not take a vow of poverty. Charities need to have paid staff to carry out their operations and to deliver the services and activities for which they are created. This week’s blog seeks to debunk some of the commonly held misconceptions about charity compensation.

Are salaries just “overhead” expenses?

There is a serious public misperception that the amount that charities pay in salaries is part of the organization’s “administrative expenses” also known by the lay term “overhead.” The reality is that charity financial statements appropriately allocate salary expenses among three major expense categories: program services, fundraising and management and general expenses. These allocations are usually based on the actual or estimated portion of staff time spent in carrying out various activities. For example, conducting research on environmental issues (program services), calling on major donors (fundraising), and meeting expenses for the board of directors (management and general.) Sometimes a single individual will carry out multiple functions and have a portion of his/her compensation recognized in each of these expense categories. In other cases, a staff member will have all his/her salary allocated to just one expense category, such as an accounting staff member’s salary recognized as management and general expense.

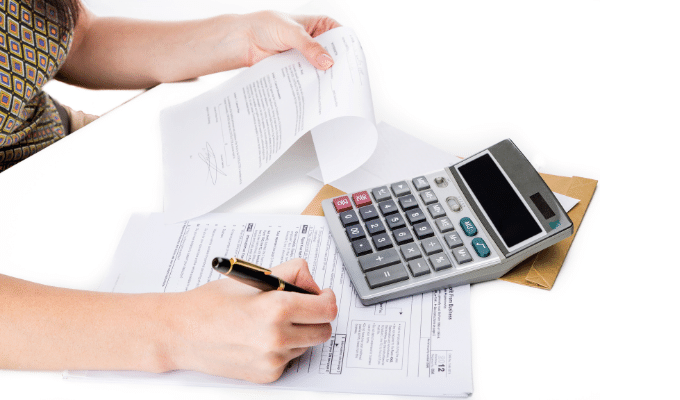

Is executive compensation of charity staff members considered public information?

Compensation information of the charity’s officers and key employees is routinely included as part of the IRS Form 990, the annual financial form completed by charities (other than houses of worship.) This transparency of compensation information has been a fact of life for charities for decades. While this openness is sometimes a challenging concept for former business executives who join the paid staff of a charity, most executives recognize this transparency as a routine aspect of philanthropy that is different than the private sector.

In response to donor interest in this area, BBB Wise Giving Alliance routinely includes the total compensation of the charity’s CEO in its evaluative reports on soliciting charities. Over the years, however, we have become aware of viral email messages and social media postings that have included false information about charity compensation at well-known charitable organizations. Be wary of sensationalistic accusations, check with trusted sources when seeking to find out about charity issues of interest.

Who is responsible for setting charity executive compensation?

Determining the compensation of the charity’s chief executive officer is one of the basic responsibilities of an organization’s board of directors. The governing board usually considers a variety of factors, including but not limited to: information gathered from nonprofit salary surveys, the geographic location of the charity’s offices, and the size of the organization finances and staff. One would not expect the CE0 of a $100 million charity to be paid the same wage as the CEO of a charity that brings in $1 million.

In any event, solely considering compensation will not provide a complete picture of a charity’s trustworthiness. Refer to the BBB Standards for Charity Accountability to better understand key factors that help verify trust.

Video of the Week

As part of our Building Trust Video Series, we are pleased to provide a video featuring Pamela Timmons, Executive Director of Good Shepherd Ministries of Oklahoma (a BBB Accredited Charity) which seeks to provide free health care for those who are low-income and uninsured in Oklahoma City, including medical services, dental services and prescription medications.

Recent Reports

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

Finally, remember to let us know by going to https://give.org/ask-us-about-a-charity1/ if you are interested in seeing a report on a charity not on the list and we will do our best to produce one.

H. Art Taylor, President & CEO

BBB Wise Giving Alliance

.jpg?sfvrsn=8073f1a5_0)