Wise Giving Wednesday: Deducting a Fundraising-Related Purchase

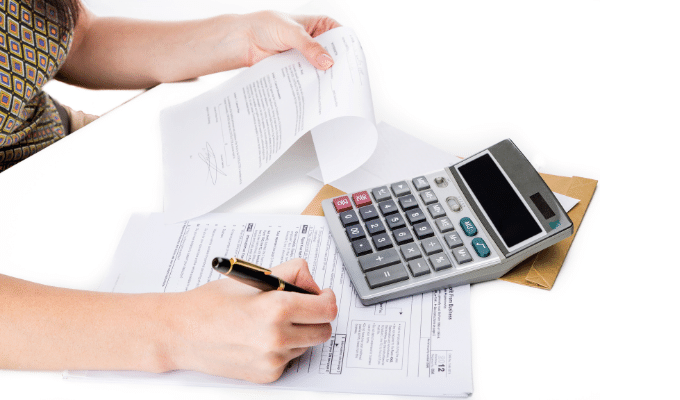

In addition to helping a good cause, one of the motivations for purchasing a ticket to a fundraising event in the U.S. is the ability to get an income tax deduction for the purchase. Donors need to keep in mind, however, that this does not mean one can claim the full purchase amount as a charity gift. IRS rules indicate that only a portion of the purchase, above the fair-market value of the ticket, would be deductible as a charitable donation.

For example, a charity is selling tickets to a charity benefit performance by a traveling musical production based on a Broadway show. The tickets would normally sell for $100 each but are being sold at $250 each for this charity event. In this case, only $150 of the purchase would be deductible. $250 purchase price ─ $100 fair market value = $150 deductibility result.

This same rule holds whether the event is a performance, golf tournament or fundraising dinner. The deductible portion is not based on how much it cost the charity per ticket to put on the event, but the market value of the benefit received by the donor/purchaser.

In addition, if the sale is more than $75, charities are required by law to include a disclosure statement in the written acknowledgement of the purchase that identifies the fair-market value of the item the donor received.

Also, the IRs indicates that “you can’t deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.”

For more information on the deductibility of such purchases, visit IRS Publication 56, Charitable Contributions and/or the following AICPA publication, Compliance Issues for Fundraising Organizations. In addition, IRS Publication 1771 includes helpful information on required charity disclosures.

Of course, we encourage all donors to learn more about the charity before participating and verify if they meet the 20 BBB Standards for Charity Accountability by reviewing the reports available on Give.org.

Video of the Week

As part of our Building Trust Video Series, we are pleased to provide a video featuring Christy Delafield, Senior Global Communications Officer, Mercy Corps, (a BBB Accredited Charity) which provides assistance to individuals and families in over 40 countries. When humanitarian disasters strike, the organization provides emergency relief, including food, water, shelter and other critical supplies. MC also helps communities move beyond the crisis and build better lives by helping them grow more food, earn higher incomes and advocate for their own needs. The organization makes small loans to help people start their own businesses; helps farmers grow better crops; and ensures that children have food, medical care and the opportunity to go to school.

Recent Reports

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

- Father Flanagan’s Boys’ Home / Boys Town

- First Nations Development Institute

- Gift of Life Marrow Registry

Finally, remember to let us know by going to /charity-inquiry if you are interested in seeing a report on a charity not on the list and we will do our best to produce one.

H. Art Taylor, President & CEO

BBB Wise Giving Alliance

.jpg?sfvrsn=8073f1a5_0)