Wise Giving Wednesday: The Importance of Audited Financial Statements

.jpg?sfvrsn=ce7e0640_0)

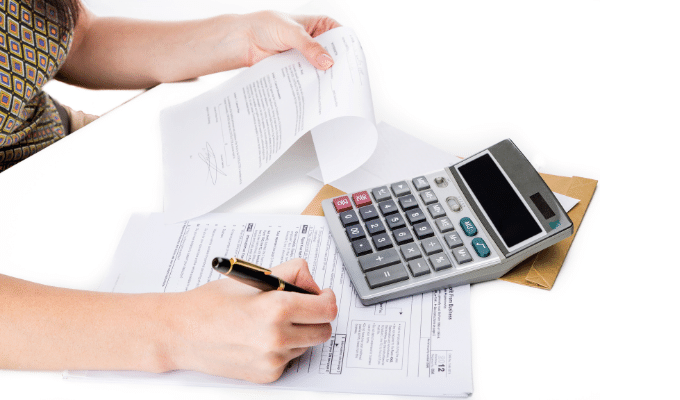

As a standards-based charity evaluator, BBB Wise Giving Alliance recognizes the value of standards and guidelines in providing a useful reference point and helping to encourage good practices. This is one of the reasons that the financial section of the BBB Standards for Charity Accountability prefers to use a charity’s audited financial statements as opposed to the IRS Form 990. Audited financial statements are prepared in accordance with GAAP (generally accepted accounting principles) which are the accounting standards established in the United States by the Financial Accounting Standards Board. In turn, the auditor’s opinion attached to audited financial statements will identify any material aberration from GAAP so that users are aware of this difference when reviewing the financial statement contents.

The IRS Form 990, the annual financial form that charities file with the IRS, is not intended to provide a financial presentation that is consistent with GAAP. As a result, in some instances, there can be significant differences between the IRS Form 990 and a charity’s audited financial statement. As two examples, audited statements include unrealized gains or losses on investments as well as, under certain conditions, donated services, while the IRS Form 990 does not permit these items to be included in revenues or expenses. When you see a charity financial reference in media, on a website, or in a fundraising letter, look closely to see if the source is clearly identified so that you know whether or not the summary is based on GAAP financial information.

BBB Charity Standard 11, requires charities to have audited financial statements when total income exceeds $1 million. For charities whose annual gross income is less than $1 million, a review by a certified public accountant is sufficient to meet this standard. For charities whose annual gross income is less than $250,000, an internally produced, complete financial statement is adequate as long as it includes the same elements (i.e., statement of financial position, statement of activities, statement of cash flows, notes, etc.) as the audited financial statements. If this is not available for such smaller charities, then the IRS Form 990 or 990-EZ Form would be sufficient.

Video of the Week

As part of our Ukraine Relief Charity Interview series, BBB Wise Giving Alliance speaks to Commissioner Kenneth Hodder, National Commander of the Salvation Army talks about the organization's relief efforts in and around Ukraine.

Heart of Giving Podcast

In this week's Heart of Giving Podcast, BBB Wise Giving Alliance goes back to its archives to collect excerpts from talks with guests who are contributing or have contributed to the education of young people. Through these clips, BBB WGA seeks to demonstrate the power of philanthropy in assisting teachers.Recent Reports

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

Finally, remember to let us know by going to give.org/charity-inquiry if you are interested in seeing a report on a charity not on the list and we will do our best to produce one.

.jpg?sfvrsn=8073f1a5_0)