Wise Giving Wednesday: Police, Firefighter, or Veterans Groups that are “527 Political Organizations”

Police, Firefighter, or Veterans Groups that are “527 Political Organizations”

BBB Wise Giving Alliance and regional BBB organizations produce evaluative reports on charities. Generally, these are organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code. As a matter of long-standing practice, we do not seek to report on political parties or other entities raising funds for political candidates. Tuesday’s print edition of the New York Times, however, had a front-page story (“Tugging Hearts to Raise $89 Million, but Sending A Scant 1% to the Causes”) that identified several political organizations tax exempt under section 527 of the Internal Revenue Code that reportedly raised millions of dollars using robocalls for “building political support for police officers, veterans and firefighters…But just spent 1 percent of the money they raised to help candidates via donations, ads or targeted get out the votes messages….”

As in every category in the fundraising marketplace, there are well managed and sincere efforts as well as those that unfortunately take advantage of generosity for popular causes. While many donors may be familiar with police, firefighter and veterans groups that have raised charitable funds over the phone, they may not be aware that 527 political organizations also may be soliciting for groups that include the words police, firefighter or veterans in their name.

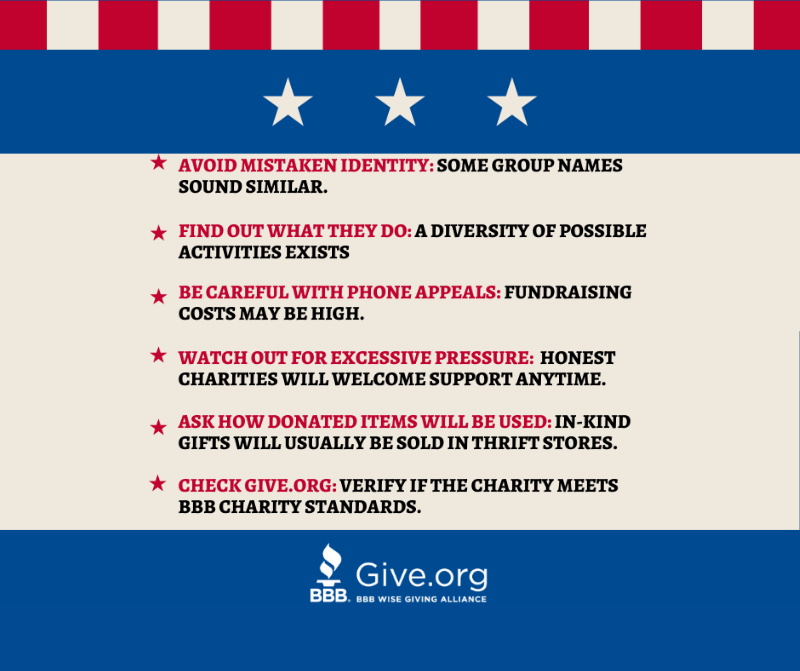

As a result, we provide the following tips to help individuals make more informed giving decisions:

Be Alert to Possible Name Confusion

The use of the words “police,” “firefighter” or “veterans” in the name of the organization does not necessarily mean that local law enforcement, firefighters or veterans are involved with the organization. The activities described in appeals can sometimes be vague. When in doubt, ask for written information to be sent to you or visit the organization’s website.

Donations May Not Be Tax Deductible

Contributions to police, firefighter or veterans organizations that are tax exempt as charities under section 501(c)(3) of the Internal Revenue Code are deductible as charitable donations for federal income tax purposes. But not all such groups are charities. Some are tax exempt as fraternal organizations, benevolent life insurance associations or in the above new instance, a 527 political organization. Unless the organization is a charity, a contribution will probably not be deductible.

Don’t Succumb to Pressure to Give

No matter which organization is calling, don’t be pressured into making an immediate donation decision. Honest efforts will welcome your donation at any time and will encourage uncertain call recipients to check them out.

Telemarketing Costs Can be Significant

Like all forms of fundraising, telemarketing can be managed well but it can also result in high expense. This is especially true for “cold” calls that solicit people who have not previously contributed. Those types of efforts can result in less than 20% of what is collected going to the named organization. Visit the latest financial statements that can be found on the group’s website. If the site does not provide access to financial information, that lack of transparency is a red flag. You can also go to the IRS website to access the latest IRS Form 990, the financial form annually filed by most nonprofit organizations. In Canada, visit the Revenue Canada website.

We recommend giving to charities that meet all 20 of the BBB Standards for Charity Accountability. Visit BBB's Give.org to access free evaluative reports on charities.

Video of the Week

As part of the Building Trust Video series, BBB WGA is pleased to provide an interview with Lynette Johnston, Executive Director, Society of St. Andrew (a BBB Accredited Charity) which develops community-based grassroots gleaning networks, where volunteers labor to pick, dig, or gather fresh produce remaining in fields after commercial harvest to reduce food waste and provide food to needy populations and food banks. The organization also acts as a consultant to churches and other nonprofit organizations and groups with a shared mission to implement best practices and effective programs. It also provides support, education, and religious edification to those in need.

Heart of Giving Podcast

This week’s Heart of Giving Podcast provides a detailed interview with Darren Isom, Partner, The Bridgspan Group, San Francisco. Mr. Isom advises mission-driven organizations and philanthropic foundations in support of equity and justuice. He also supports the firm’s work with arts and cultural organization.

Recent Reports

Finally, remember to let us know by going to give.org/charity-inquiry if you are interested in seeing a report on a charity not on the list and we will do our best to produce one.

.jpg?sfvrsn=8073f1a5_0)