Wise Giving Wednesday: IRS Incentives for 2021 Charitable Contributions

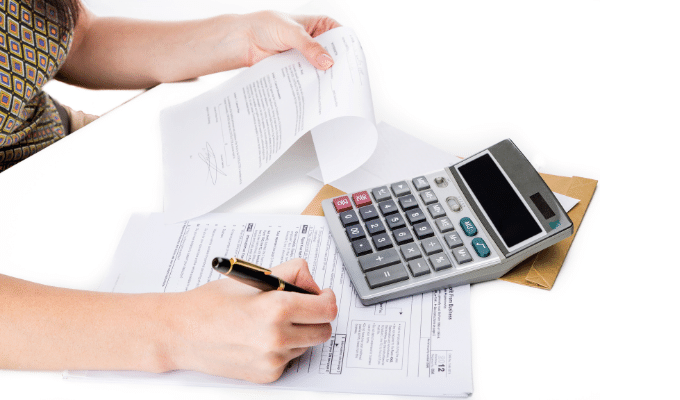

This week the Internal Revenue Service posted an article informing U.S. taxpayers of additional benefits to making charitable donations before the close of 2021. There is a special temporary rule that now allows married couples filing jointly to deduct up to $600 in cash donations to charities and individuals up to $300 in donations even if they don’t itemize on their tax returns. As the IRS indicates that nearly 90 percent of taxpayers take the standard deduction, this option opens up additional incentives for making contributions before the end of the year.

Several years ago, the standard deduction was significantly increased. For the 2021 tax year, the standard deduction will be $12,550 for individual taxpayers and $25,100 for married couples filing a joint return. As a result, the vast majority of households now take this deduction instead of providing itemized deductions which is where one would reduce taxable income by declaring charitable donations made in the tax year.

This deduction option for non-itemizers is restricted to cash donations. The IRS defines cash donations as “…those made by check, credit card or debit card as well as amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with their volunteer services to a qualifying charitable organization. Cash contributions don't include the value of volunteer services, securities, household items or other property.”

Also, BBB Wise Giving Alliance encourages those seeking to take such deductions to do two things. First, verify that the organization receiving your donation is eligible to receive contributions that are deductible as charitable gifts. Generally, this means the organization is tax exempt under section 501(c)(3) of the Internal Revenue Code. To assist in this verification, search the IRS Publication 78 database. Also, please visit BBB’s Give.org to verify if the organization is a BBB Accredited Charity (i.e., meets the 20 BBB Standards for Charity Accountability.)

For additional assistance on this topic, see the following IRS publications:

12/13/2021 Announcement on Charitable Tax Benefits

IRS Publication 526; Charitable Contributions

Donors in Canada seeking guidance on charitable tax credits can visit this link.

Video of the Week

As part of our Building Trust Video Series, we are pleased to provide a video featuring an interview with Miki Jordan, President & CEO of Wayfinder Family Services (a BBB Accredited Charity), which offers services for individuals of all ages with vision loss and, often, additional disabilities through the organization's early intervention, education, recreation, mental health, workforce readiness and rehabilitation services.

Heart of Giving Podcast

This week’s Heart of Giving Podcast revisits a 2020 interview conducted with Dr. Helene Gayle, CEO of the Chicago Community Trust. Dr. Gayle talks about her passion for causes during her youth, the relationship between healthcare and economic concerns and how the Chicago Community Trust impacts communities in the Chicago region.Recent Reports

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

Finally, remember to let us know by going to give.org/charity-inquiry if you are interested in seeing a report on a charity not on the list and we will do our best to produce one.

H. Art Taylor, President & CEO

BBB Wise Giving Alliance

.jpg?sfvrsn=8073f1a5_0)