Wise Giving Wednesday: Police and Firefighter Appeals

Recent news reports about the bravery of fallen firefighters and the shooting of police when addressing domestic incidents brings attention and sympathy to these public servants. This spotlight, however, is likely to also give rise to a growth in solicitations from a variety of police and firefighter organizations seeking contributions. As in every topic category in the charitable marketplace, there are well-managed and sincere efforts as well as those that unfortunately seek to take advantage of generosity for popular causes. In this spirit, Wise Giving Wednesday offers the following advice in considering requests for support.

The High Cost of Phone Call Fundraising

For more than half a century, countless numbers of police and firefighter

groups have used phone appeals as the main source of raising money. In most

instances, such appeals consist of what is known as “cold calls”

– requesting donations from individuals who are not previous donors.

Such fundraising usually results in very high fundraising expenses with 20% or

less of collected funds being directed to the organization’s program

service activities. Unless solicitors are misrepresenting their financial

information in appeals, government agencies are unlikely to be able to address

such financial arrangements. In terms of the voluntary 20 BBB Standards for Charity Accountability, Standard 9 specifically calls for a charity’s total fundraising

expenses not to exceed 35% of contributions. In applying this standard, BBB

Wise Giving Alliance looks at the past year’s financial statements, not

just a single campaign circumstance.

Implying Help for Local Officers or Firefighters

The use of the words “police” or “firefighter” in the name of the organization does not necessarily mean that local firefighters or law enforcement officers will be receiving help. Appeals can sometimes be vague on this point. When in doubt, seek out additional information by asking for written information, visiting the organization’s website and/or seeking out reports form third-party sources such as Give.org and the Better Business Bureau serving your area.

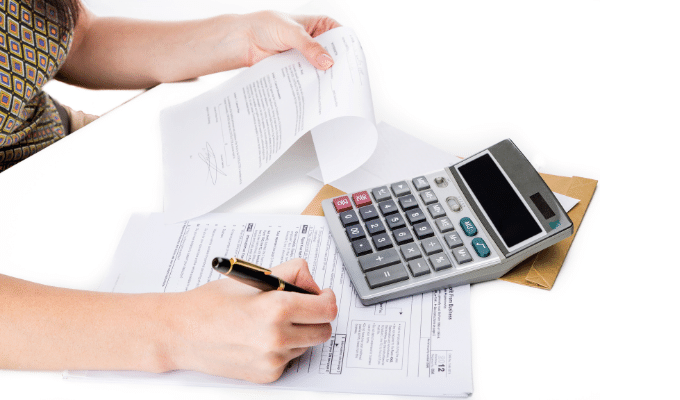

Donations May Not Be Tax Deductible

Donations to police and firefighter organizations that are tax exempt as charities under section 501(c)(3) of the Internal Revenue Code are deductible as charity contributions for federal income tax purposes. But not all such groups have that tax-exempt status. Some are tax exempt as fraternal organizations, benevolent life insurance associations or some other tax-exempt status. Unless the organization is tax exempt as a charity, a contribution might not be deductible.

Pressure to Donate

Be wary of any solicitor pressuring potential donors to make an on-the-spot gift decision. Honest organizations will welcome support at any time and will encourage you to give with confidence after addressing any questions or concerns that might be raised.

For additional assistance on this topic, see the following tips, search for charity reports and use other resources available at Give.org and BBB.org.

Video of the Week

As part of our Building Trust Video Series, we are pleased to revisit a video featuring an interview with Andrea J. O’Neill, Executive Director, Lupus Research Alliance (a BBB Accredited Charity) which seeks to find better treatments and support medical research to ultimately prevent and cure systemic lupus erythematosus (SLE or lupus), a debilitating autoimmune disease.

Heart of Giving Podcast

This week, Heart of Giving Podcast features Dr. Una Osili, the Associate Dean of Research and International Programs at the Indiana University Lilly Family School of Philanthropy. Among other responsibilities, she leads the Giving USA Research. This week she sheds more light on some of the themes discussed in last week’s episode where we reviewed emerging trends.

Recent Reports

We are always working with charities to publish or update reports for donors. Visit Give.org or local BBBs to check out any charity before giving. Our recently evaluated charities include:

Finally, remember to let us know by going

to give.org/charity-inquiry if you are interested in seeing a

report on a charity not on the list and we will do our best to produce one.

H. Art Taylor, President & CEO

BBB Wise Giving Alliance

.jpg?sfvrsn=8073f1a5_0)